It is undeniable that the pandemic has accelerated the penetration of e-commerce, but a chunk of that acceleration was not driven by convenience, but rather by the accessibility of brick and mortar stores.

So while the consumer uptake of e-commerce is only going to keep growing, the trend is not homogeneous across all e-commerce verticals. One such vertical that has been subject to this fickle demand is groceries.

The pandemic has turned the tides on grocery shopping at brick and mortar stores and caused a forced conversion to online grocery shopping, and for a short while, Egyptian consumers got to experience buying groceries online with all its flaws and frustrations.

With the onslaught of demand weighing heavily on service providers as they tried to keep up, but not all players suffered, in fact, some thrived.

The competitive landscape in Egypt’s online grocery shopping is vibrant to say the least. The pandemic motivated small players to flock the market and large players to hastily expand their existing operations or venture into groceries for fear of missing out on the growing opportunity.

Several business models are at play, but a noticeable difference between these models is that some bet on the sustainability of demand captured during curfew and social distancing, while others realize this demand volatility and are built to retain consumers looking for more than an alternative to brick and mortar.

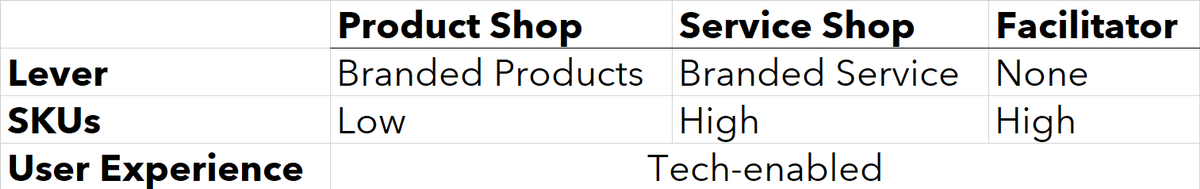

If we can put Egypt’s market players on a spectrum, they would largely be defined by the following 3 categories; Product Shops, Service Shops and Facilitators. The Shops rely on differentiated offerings, while the Facilitators chase the market opportunity and are driven by a fear of missing out.

Product and service levers

On one end of the spectrum, product shops are tech-enabled dark stores that rely on a core set of products unique to them to acquire users.

They aggressively market their brand and associate it with their offerings that could be anything from coffee to fresh produce. Product shops build trust with consumers over long periods of time and with recurring purchases.

Locked-in consumers are then upsold as the Product Shop expands into other verticals and adds some ancillary products that could complement its primary offerings.

Further along the spectrum, Service Shops are also tech-enabled darks stores that rather rely on excelling at providing good service and a painless user experience.

Instead of relying on a core product offering, Service Shops featurize the grocery shopping experience by offering a bundle of add-on services that throws consumers into a habit of ordering. Service Shops aim to disrupt any of the facets of grocery shopping, including pricing, delivery times, product browsing and purchasing.

“Come for the *insert core product* stay for the *insert ancillary product*”.

Grocery-as-a-Shoo-in-Service

At the onset of the pandemic, a slew of local delivery companies scrambled to partner up with brick and mortar stores, recruit drivers and extend operating hours.

Unlike restaurants though -the primary offering of these delivery companies- grocery stores purchase, stock and sell thousands of SKUs, inventory levels are volatile and pricing is dynamic.

Looking for a fast go-to-market and a flexible model with limited investment, delivery services opted for the Facilitator model, which typically aims to emulate the experience of shopping and brick and mortar stores by stocking a high number of SKUs and a wide variety of products, betting on a consumer that would rather spare themselves a trip to the store.

But with a lot of moving parts in the grocery business, it becomes quite difficult to replicate on a third-party delivery platform. The end result is that consumers are left with an offering that visually looks familiar to a usual trip to the grocery store, but then are left with a frustrating experience.

Egypt’s big metropolitan cities and dense urban areas are perforated with all sorts of grocery outlets; from the small corner shops to the mega chains, big cities are in no shortage of options.

Absence the pandemic, the mere availability of an online shopping option is not enough of a value proposition to retain consumers.

Winners and Losers

With curfew and lockdowns lifted and people no longer restricted in mobility, brick and mortar stores are almost instantly becoming the primary option for grocery shopping and the value proposition of Facilitators quickly becomes diluted.

This is not a dismissal of the changing market dynamics, but an acknowledgement that the true winners are those that leverage their branded, differentiated offerings in acquiring and retaining consumers.

While consumers are unlikely to handover their entire monthly basket of grocery purchases to Product Shops or Service Shops, they will find a reason to replace certain items or even grow the size of their baskets.